Back

28 Aug 2023

Gold Futures: Potential rebound on the cards

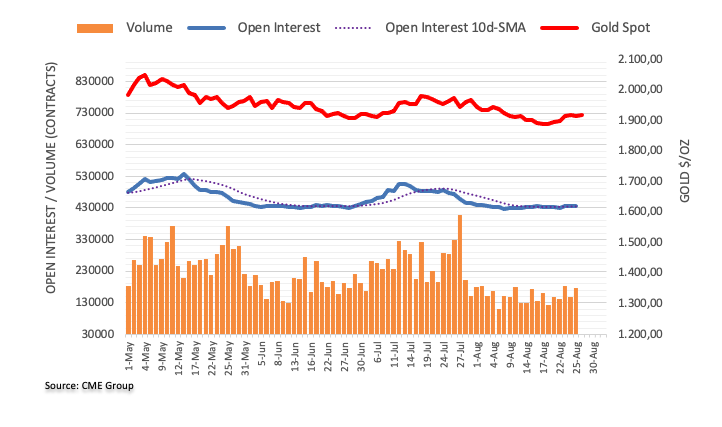

CME Group’s flash data for gold futures markets noted traders reduced their open interest positions by just 575 contracts on Friday, adding to the previous daily drop. Volume, instead, reversed the previous daily pullback and increased by nearly 31K contracts, keeping the erratic performance well in place for the time being.

Gold: Positive outlook above the 200-day SMA

Friday’s small downtick in gold prices was on the back of a marginal drop in open interest, which hints at a potential near-term rebound. In the meantime, the yellow metal should shift to a constructive outlook once it clears the 200-day SMA ($1910) in a convincing fashion.