WTI firmer, moves north of $62.00 on EIA

- Crude oil prices test highs above $62.00 on EIA report.

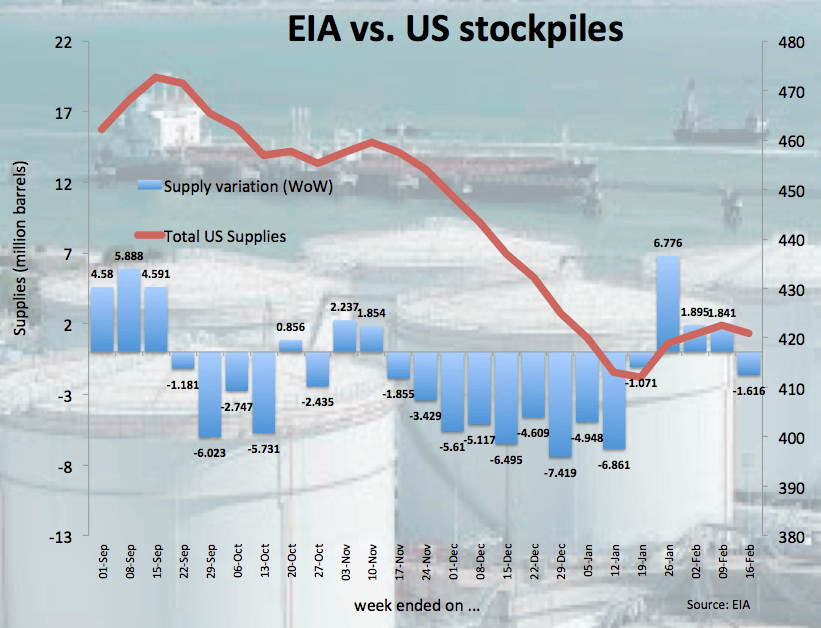

- Oil supplies dropped last week vs. a forecasted 1.8 mbpd build.

- Baker Hughes’ US oil rig count next on tap on Friday.

Prices of the barrel of the West Texas Intermediate are navigating the area of daily highs above the key $62.00 mark in the wake of an upbeat report from the EIA.

WTI firmer above $62.00

After two consecutive sessions with losses, prices of the WTI are now recovering the smile, although they keep the broader consolidative theme so far this week.

WTI advanced on Thursday after the EIA reported crude oil supplies dropped by 1.616 million barrels vs. a forecasted build of nearly 1.8 million barrels. In addition, weekly distillates stocks went down by 2.422 million barrels and gasoline stockpiles rose by 0.261 million barrels.

Further data saw supplies at Cushing decreasing by 2.664 million barrels, adding to last week’s 3.642 million barrels drop.

Looking ahead, driller Baker Hughes will publish its weekly report on US oil rig count on Friday.

WTI significant levels

At the moment the barrel of WTI is gaining 1.79% at $62.51 facing the next up barrier at $62.72 (high Feb.20) seconded by $62.82 (21-day sma) and finally $64.13 (23.6% Fibo of $55.74-$66.72). On the downside, a break below $60.88 (low Feb.22) would open the door to $59.93 (61.8% Fibo of $55.74-$66.72) and finally $58.10 (low Feb.9).