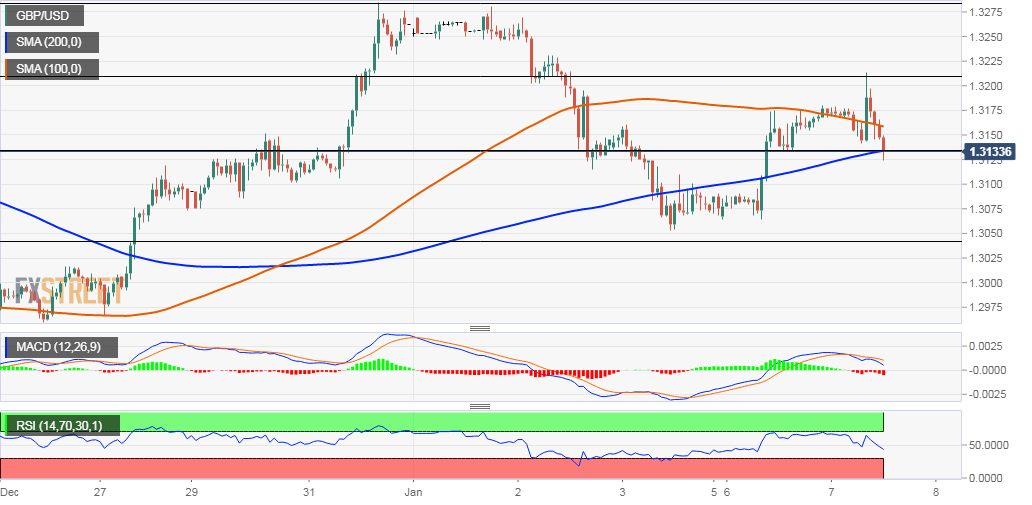

GBP/USD Technical Analysis: Turns vulnerable below 200-hour SMA/38.2% Fibo. confluence support

- GBP/USD fails to capitalize on an intraday move beyond the 1.3200 mark.

- The set-up remains in favour of bearish traders, albeit warrant some caution.

The GBP/USD pair continued with its struggle to find acceptance above 100-hour SMA and faded a knee-jerk intraday bullish spike to levels beyond the 1.3200 handle.

The pair dropped to fresh session lows in the last hour, with bears now looking to extend the slide further below 38.2% Fibonacci level of the 1.3515-1.2905 recent downfall.

The said support coincides with 200-hour SMA. Sustained weakness below the mentioned confluence support now seems to pave the way for a further depreciating move.

Meanwhile, technical indicators on the 1-hourly chart have against started gaining negative momentum and reinforce the bearish set-up amid a modest US dollar rebound.

However, oscillators on 4-hourly/daily charts have still managed to hold in the bullish territory and warrant some caution before placing any aggressive bearish bets.

From current levels, immediate support is pegged near the 1.3100 handle, below which the pair is likely to accelerate the fall further towards mid-1.3000s (23.6% Fibo.).

On the flip side, 100-hour SMA, around the 1.3165 region, now becomes immediate resistance and is followed by the 1.3200 handle ahead of the 1.3215 region (50% Fibo.).

GBP/USD 1-hourly chart