Back

10 Feb 2020

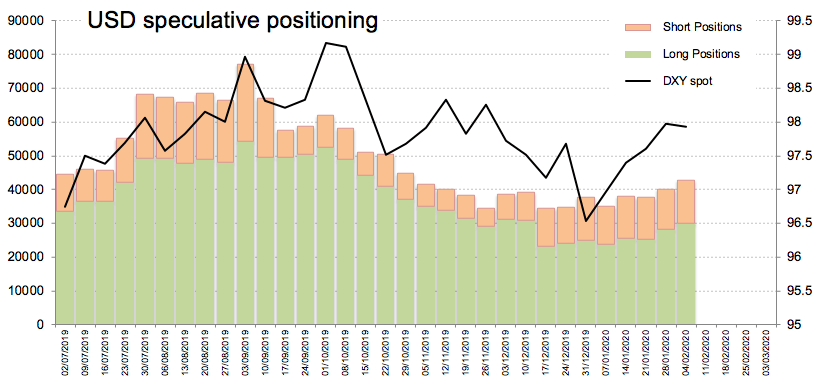

CFTC Positioning Report: USD net longs rose to multi-week highs

These are the main highlights of the CFTC Positioning Report for the week ended on February 4th:

- Speculators added gross longs for the second consecutive week, taking the net position to the highest level since December 17th. Positive US results from domestic fundamentals in combination with broad-based weakness in the dollar’s rivals have been supporting the bid tone in the buck and pushed DXY to new yearly highs.

- EUR net shorts increased to the highest level since mid-October 2019, as poor results in the German docket noted the slowdown in the broader Euroland is showing no signs of (immediate) reversion. In addition, safe haven demand on the back of the coronavirus outbreak has been also weighing on the single currency.

- Net longs in crude oil reduced to the lowest level since October 29th 2019, as traders remain on the defensive following the impact of the coronavirus on the Chinese (and global) demand for oil. In addition, the decision by the OPEC+ to extend the output cut agreement and implement deeper cuts still faces some resistance from Russia, keeping the sentiment well depressed.