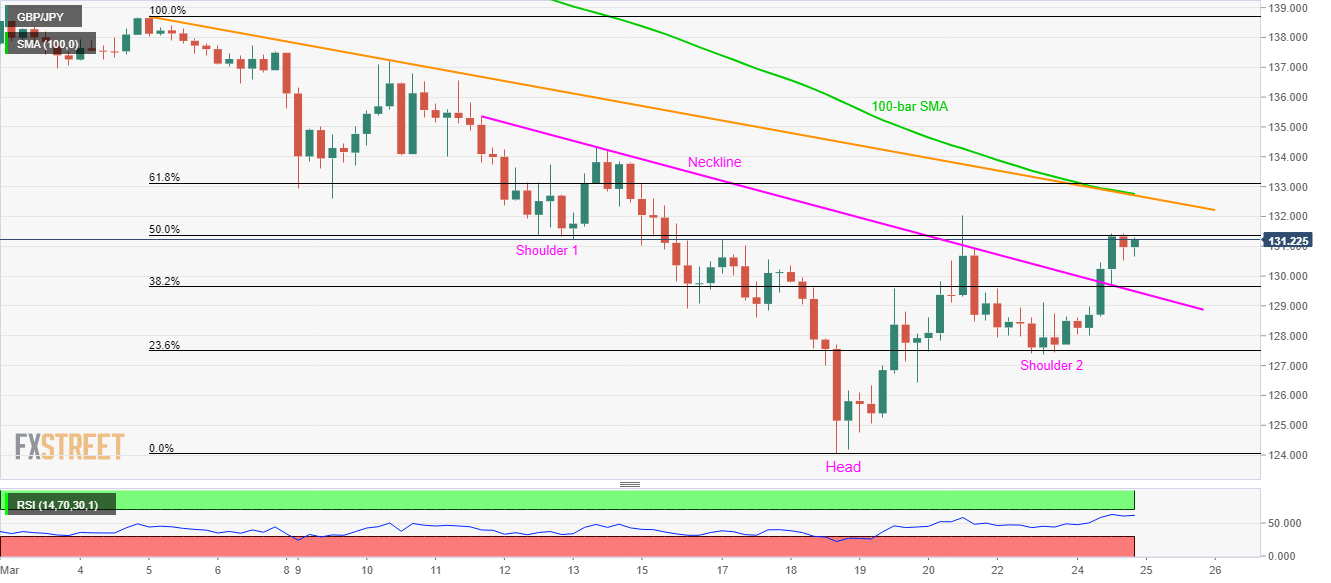

GBP/JPY Price Analysis: Positive after confirming inverse head-and-shoulders on H4

- GBP/JPY holds onto recovery gains after confirming the bullish chart pattern.

- 100-bar SMA, monthly resistance line in focus.

- 23.6% Fibonacci retracement, 126.15 add to the supports.

Having confirmed the inverse head-and-shoulders bullish pattern on the four-hour (H4) chart, GBP/JPY remains positive around 131.20 amid the early Wednesday morning in Asia.

The pair currently heads to the confluence of 100-bar SMA and the monthly falling trend line, near 132.70/75.

Also adding upside filter is the 61.8% Fibonacci retracement of its current month declines, at 133.10.

In a case where the bulls manage to dominate past-133.10, odds of witnessing 137.20 back to the chart can’t be ruled out.

If at all the GBP/JPY prices slip below the neckline of 129.50 and defy the bullish formation, 23.6% Fibonacci retracement near 127.50 can question the sellers.

Should there be a clear downside past-127.50, 126.15 and the monthly low near 124.00 will be on the sellers’ radar.

GBP/JPY four-hour chart

Trend: Further recovery expected