Back

30 Mar 2020

US Dollar Index Asia Price Forecast: DXY attempts to stabilize near the 99.00 handle

- US dollar index (DXY) starts the week with a modest bounce to the 99.00 level.

- The level to beat for bulls is the 100.00 handle.

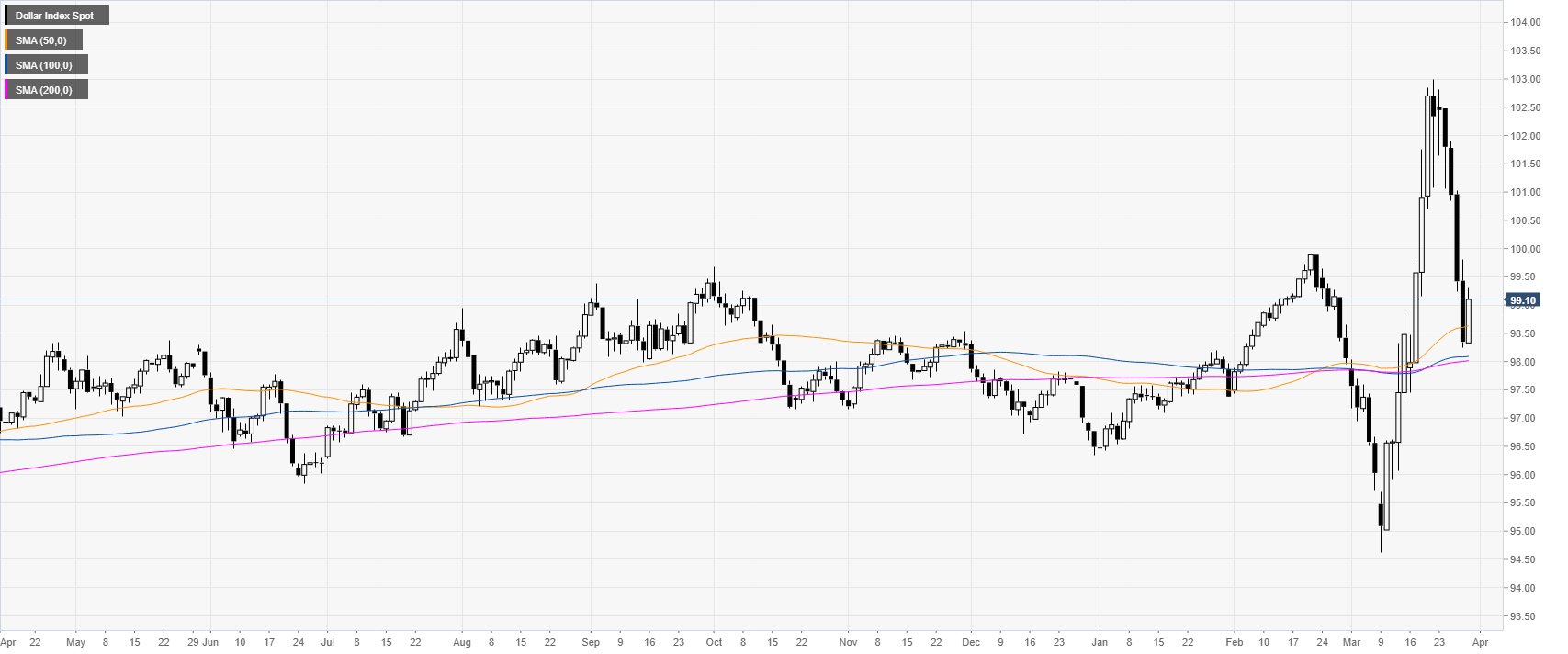

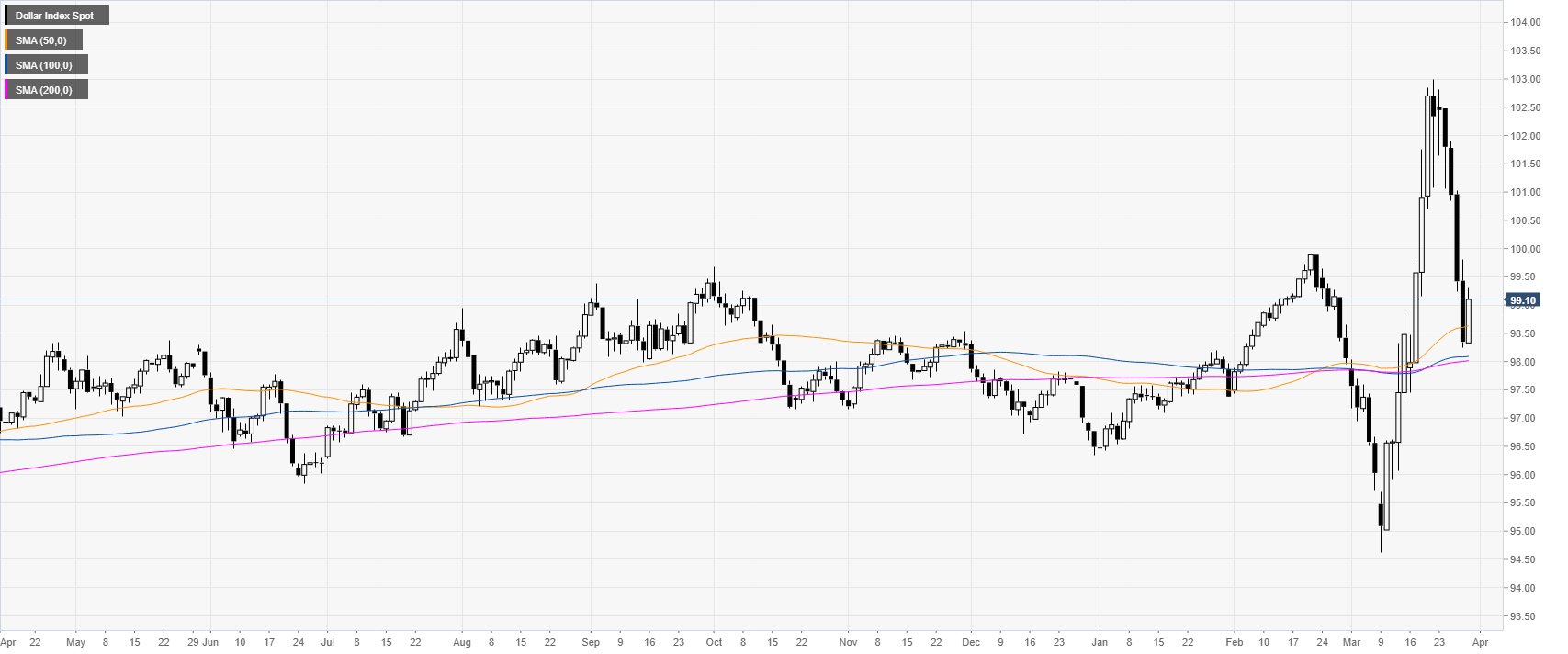

DXY daily chart chart

Last week, DXY had its worst weekly decline since April 1986 as the bearish pressure remained unabated and the greenback challenges the 50-day simple moving average on the daily chart.

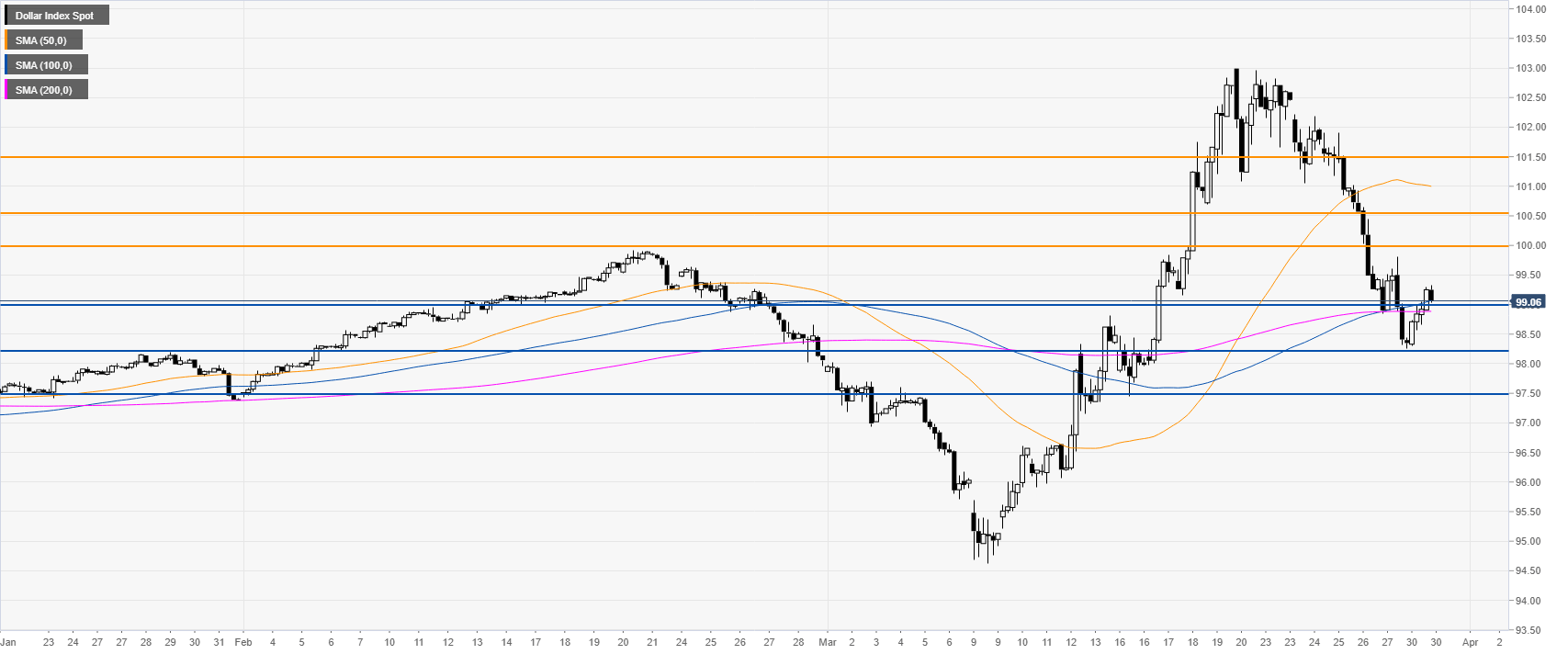

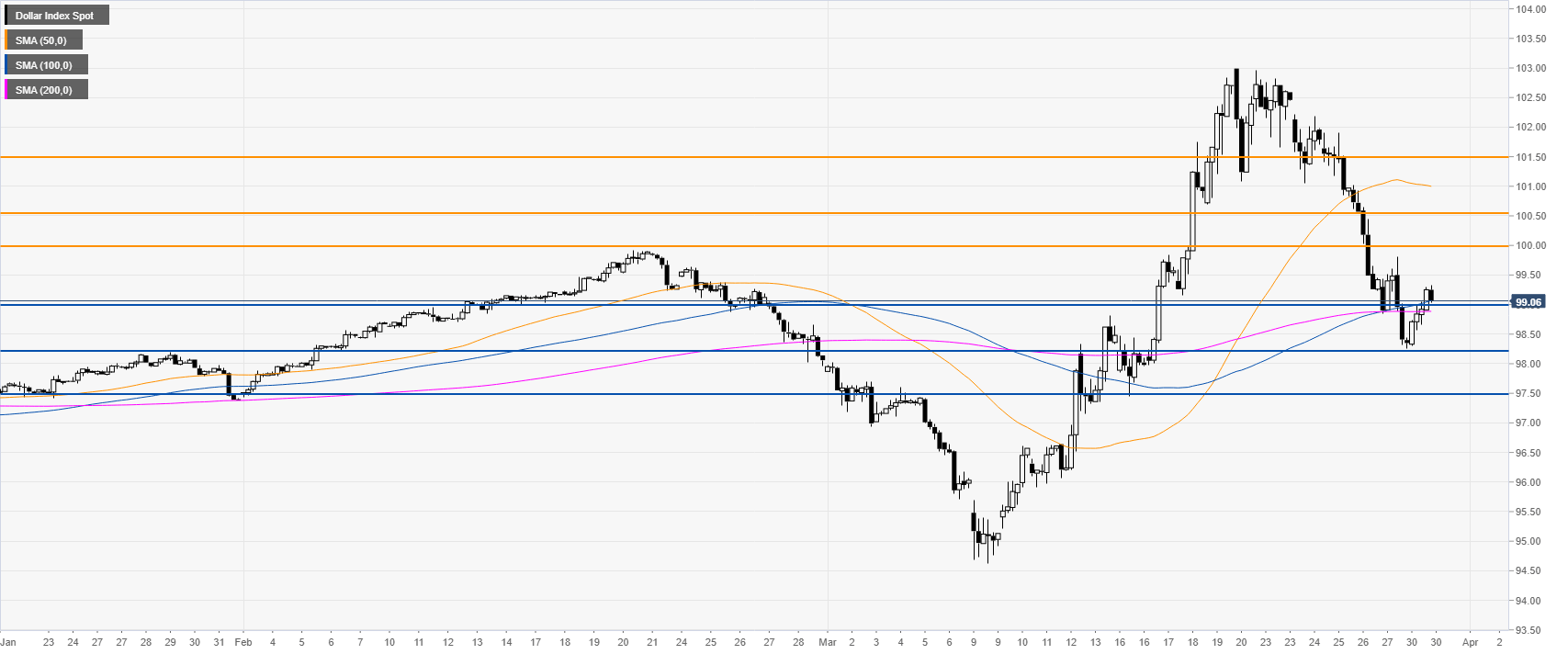

DXY four-hour chart

The bearish pressure somewhat eased at the start of the week as the greenback is attempting to regain the 99.00 handle and the 100/200 SMAs. The market is still making lower lows and highs suggesting a downward bias in the medium term as bears want to break below the 98.25 and 97.50 support levels. On the flip side, a break above the 100.00 big figure would be needed for bulls to be back in control. Further up lie the 100.50 and 101.50 resistances.

Additional key levels