USD/INR Price News: Indian rupee buyers catch a breath after two-day gains

- USD/INR pauses for further directions after declining the previous two days.

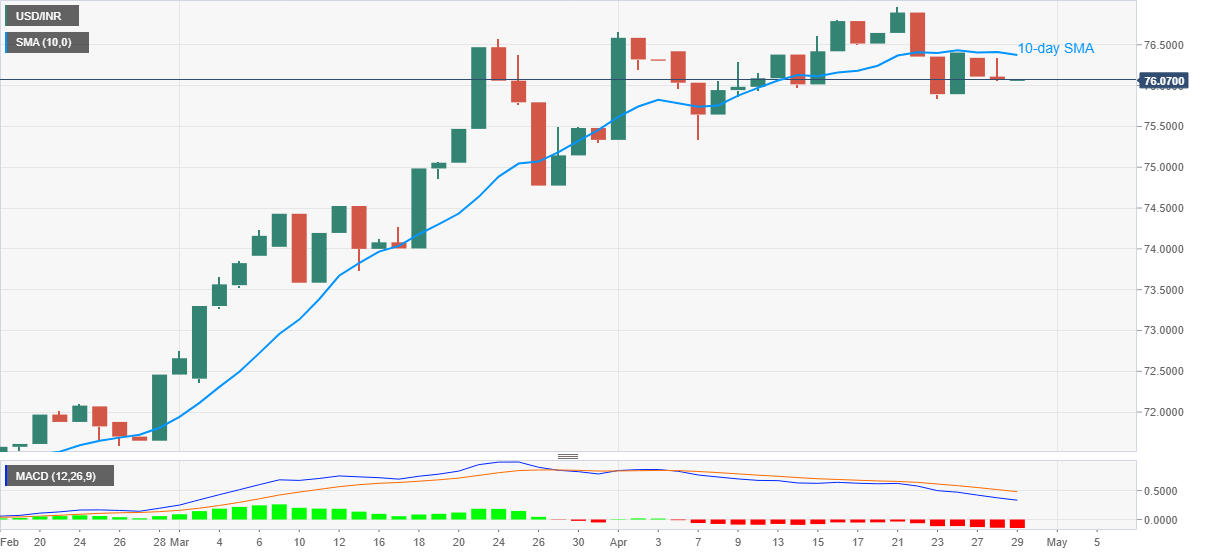

- Sustained trading below 10-day SMA, bearish MACD keep sellers hopeful.

- Buyers are less likely to be convinced unless successfully breaking 77.00.

USD/INR remains modestly changed to 76.07 as global traders await European bells on Wednesday.

The pair dropped for the two consecutive days after taking a U-turn from 10-day SMA on Friday.

Not only the pair’s inability to cross 10-day SMA but bearish MACD also increases the odds for the pair’s further downside.

In doing so, the previous week’s low near 75.85 and the monthly bottom surrounding 75.35/33 will be on the sellers’ radars.

Alternatively, a daily close beyond 10-day SMA level of 76.38 will push buyers towards the March month top close to 76.65 and the current monthly peak around 77.00.

However, a major bullish formation is less likely to take place until the quote manages to registers a daily close beyond 77.00, which if happens could push the bulls to 80.00 mark.

USD/INR daily chart

Trend: Further downside expected