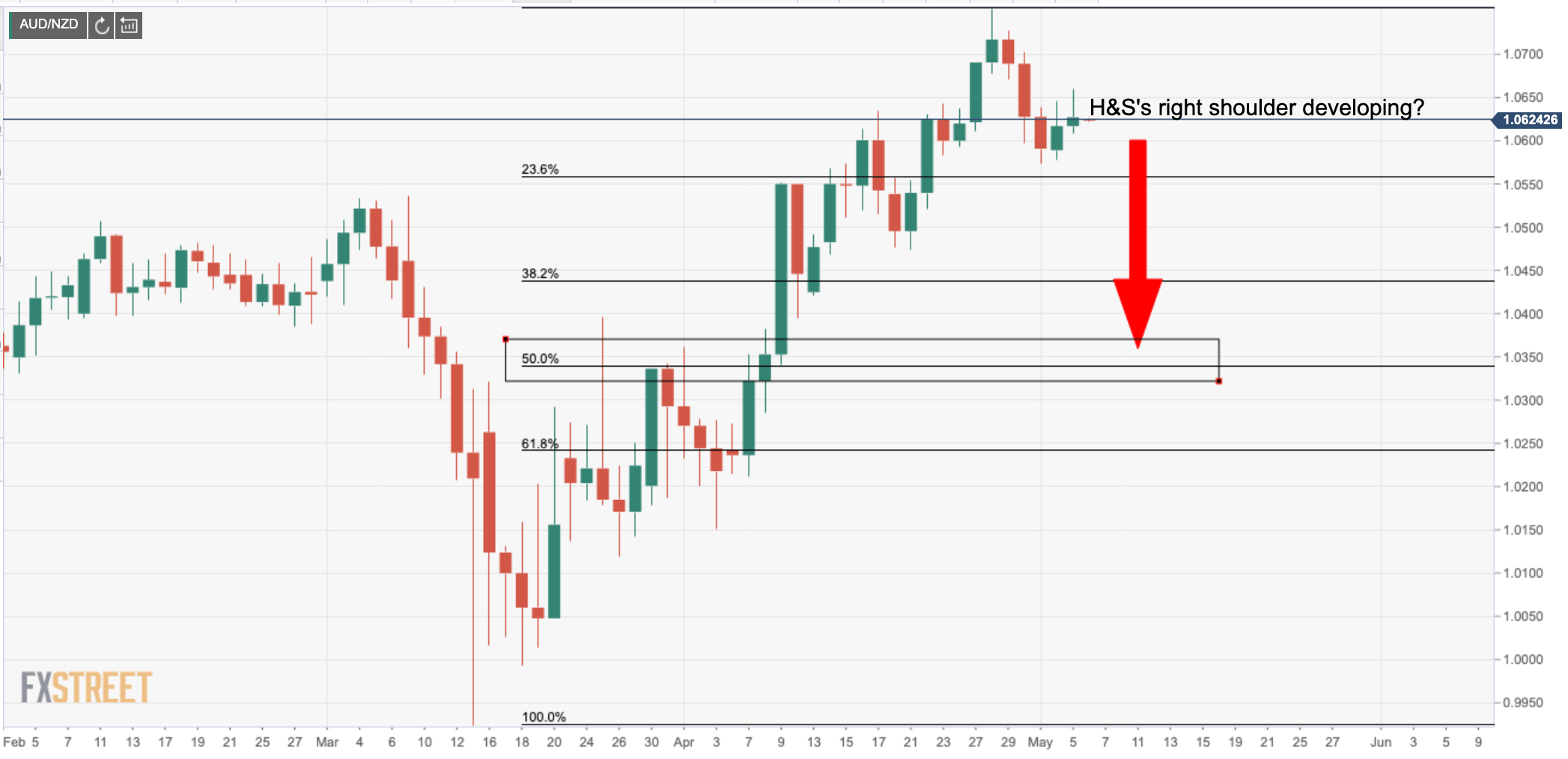

AUD/NZD consolidates in key territories, H&S in the making

- AUD/NZD holding in precariously bullish territory.

- H&S in the making which opens a 50% mean reversion target.

AUD/NZD is currently trading at 1.0623 having traded between a low of 1.0612 and a high of 1.0651, steady following the release of the NZ unemployment data and ahead of Aussie Retail Sales later today.

Firstly, is critical to know that the antipodeans are pushing the envelopes as fas the Reserve Bank of New Zealand and Australia will be concerned. While the RBA may not have mentioned it, the Aussie for sure is at a lofty level and too is the kiwi while has appreciated by 13% since the mid-March and pandemic lows.

"The RBA passed up another opportunity to comment on the exchange rate in today's policy statement making it the third time in a row," analysts at Westpac noted, however, adding, "it's fair to note that the A$ is well above levels prevailing ahead of the announcement of QE on March 19 and slightly above the levels when the RBA cut rates on March 3 too. Thus, the currency is not playing its traditional role of acting as a key mechanism through which monetary policy supports the Australian economy."

Time to give up the ghost for the antipodeans?

For both currencies, they have enjoyed some very encouraging virus containment results. We have seen a series of risk-on waves hitting the markets pertaining to the sentiment surrounding nations getting back to work. However, these have been small steps up a mountain of risk and headwinds for these currencies which are closely linked to global trade. The prospects of China and the US heading back into the ring for round two of the trade wars are going to be a major risk for the antipodeans.

Pompeo and Trump ratcheted up US and China tensions

The Reserve Bank of New Zealand is speculated to be cutting rates again and this may prove to be an obstacle to a sustained NZD rally. Again, NZD's resilience is bound to be seen as problematic for the RBNZ – meaning that the central bank would prefer that there are possibilities that there will be further cuts to come felt in the market.

Meanwhile, in today's data, there was a muted reaction to the jobs numbers for Q1 as they do not fully represent the damage done to the economy subsequent t the lockdown which officially started on 25 March.

-

NZ Unemployment Rate: 4.2% (exp 4.4%; prev 4.0%)

AUD/NZD levels

With the price beginning to form what appears to be the making of a right shoulder of a topping H&S pattern, on the wide, the 1.0377 falls in as a mean reversion target of the late March rally. The 38.2% of the same range falls in-line with a critical structure made up of prior support and resistance, this comes in at 1.0466. However, on a continuation, bulls will seek a break above 1.0850 and the 2019 August and Nov highs.