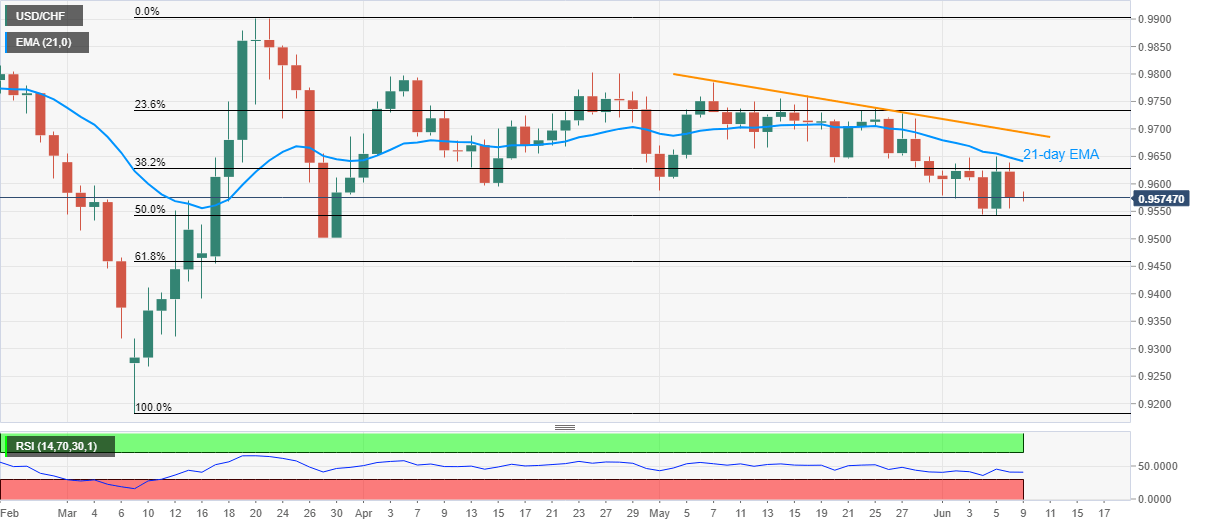

USD/CHF Price Analysis: Struggles between 21-day EMA, 50% Fibonacci retracement

- USD/CHF stays range-bound near 0.9580 after the Swiss Unemployment Rate.

- Switzerland’s Unemployment Rate dropped below a 3.7% forecast to 3.4% in May.

- Late-March low, monthly resistance line become additional filters to watch.

USD/CHF drops from 0.9582 to 0.9575 after the Swiss Unemployment Rate slipped below market consensus during the early Tuesday.

Read: Swiss Unemployment Rate ticks higher to 3.4% in May vs. 3.7% expected

Even so, the pair stays inside a key short-term trading range between 21-day EMA and 50% Fibonacci retracement of March month upside.

Hence, the pair’s current fall might bounce off a 50% Fibonacci retracement level of 0.9543, if not then March 27 low near 0.9500 could lure the bears.

In a case where the sellers dominate past-0.9500, 61.8% Fibonacci retracement level of 0.9458 could become their favorites.

On the upside, buyers are less likely to enter unless witnessing a daily closing beyond 0.9640, comprising 21-day EMA.

Though, a downward slopping trend line from May 07, at 0.9695 might question the bulls past-0.9640.

USD/CHF daily chart

Trend: Sideways