GBP/USD Price Analysis: Drops toward previous resistance below 1.3800, UK GDP in focus

- GBP/USD stands on a slippery ground near four-day low.

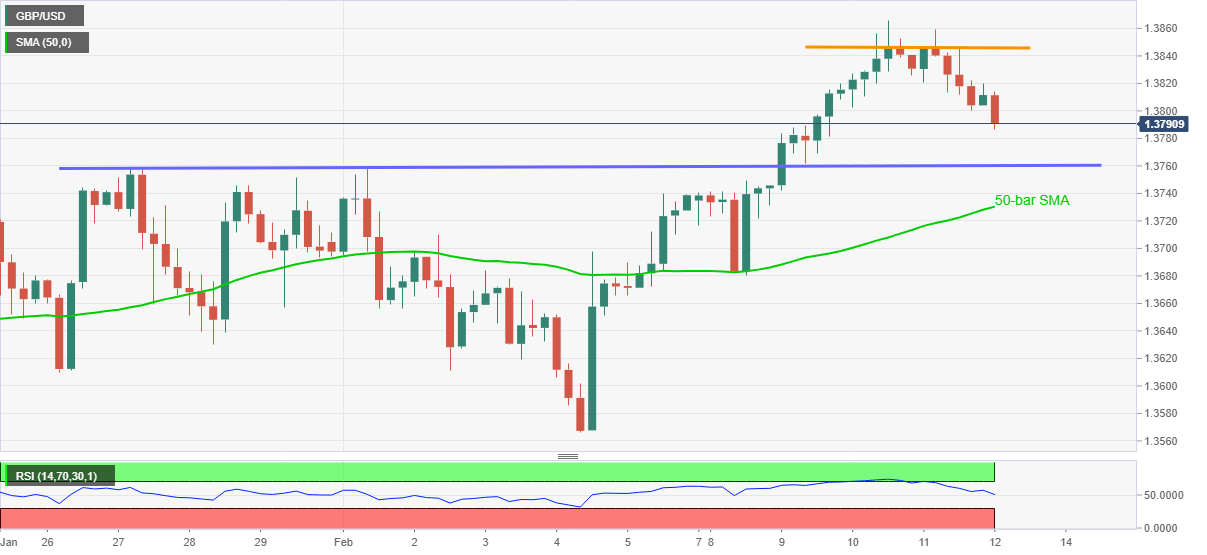

- Multiple failures to stay beyond 1.3850, overbought RSI drags the quote.

- 50-bar SMA adds to the downside filter below horizontal support.

- UK GDP likely to ease on QoQ, YoY figures may improve.

Having recently refreshed intraday low to 1.3786, GBP/USD sellers catch a breather near 1.3889, down 0.20% on a day, during the early Friday. The cable traders bear the burden of the US dollar gains ahead of the preliminary readings of the UK’s fourth-quarter (Q4) GDP, up for publishing at 07:00 AM GMT.

Read: UK GDP Preview: Buy the rumor, sell the fact? BOE's bullish stance may backfire

With the pair’s repeated pullbacks from 1.3850 joining overbought RSI, GBP/USD sellers decided to attack Tuesday’s low. However, a horizontal line comprising the previous highs marked during the late January and February’s start, around 1.3760, offers a tough nut to crack for the sterling bears.

Even if the quote drops below 1.3760, a 50-bar SMA level of 1.3730 will be the key as it holds the gate to further weakness targeting the weekly low around 1.3680.

Meanwhile, an upside clearance of 1.3850 will have to cross the recent top surrounding 1.3866 before eyeing the 1.3900 threshold.

Also acting as an upside filter is the early-April 2018 low near 1.3965 and the 1.4000 psychological magnet.

Overall, GBP/USD extends pullback ahead of the key event that is expected to recall the bears. However, there are multiple barriers before the quote drops the broad uptrend.

GBP/USD four-hour chart

Trend: Further weakness expected