GBP/USD bulls stepping in following heavy selling

- GBP/USD bulls are coming to the table as the price stalls on profit-taking.

- Bears will be lurking according to the US dollar smile theory.

- BoE will be critical for the trajectory of the pound and markets eye covid risk following Freedom Day.

GBP/USD is currently trading off the lows scored at the start of the New York session at 1.3571 and has since taken out the 1.36 figure to trade near 1.3620, down 0.38%.

The price fell again from a high of 1.3672 at the start of the European session, extending the start of the covid fear-induced week's sell-off.

Cable is now recovering from a five-month low against the dollar and close to a five-week low against the euro, levels reached due to the broad demand for the safe-haven dollar amid a global surge in coronavirus infections.

ironically, England lifted all COVID-19 social restrictions on Monday, in what local media dubbed "Freedom Day", despite a surge in infections caused largely by the highly contagious Delta variant of the virus.

Risk-off ones are a tad tamer on Tuesday but the fears are lingering while COVID-19 restrictions are being implemented again in European countries after recent spikes.

As a result, the DXY is up for the fourth straight day and it traded at the highest level since April 5 near 93.04.

Bulls are eyeing the March 31 high near 93.437.

The euro remains heavy ahead of the ECB decision Thursday which is also playing into the hand of the US dollar.

The dollar is gaining from strong US data as well as from risk-off activity which supports the dollar smile theory.

''Rising virus numbers and political bumbling in the UK are leading sterling to trade at new lows for this cycle The break below $1.3755 yesterday sets up a potential test of the January low near $1.3450. Ahead of that is the February low near $1.3565,'' analysts at Brown Brothers Harriman argued.

BoE eyed and will be key for GBP

Meanwhile, with a focus on the Bank of England, the next BOE meeting is August 5 and a dovish hold is expected.

The analysts at BBH said, ''Bank of England policymakers are undergoing a similar debate as the Fed.''

''Last week’s Consumer Price Index data came in higher than expected, but officials, for the most part, continue to frame this as a transitory spike.''

''External MPC member Mann warned that 'the recovery from Covid is more fragile than might appear,” and so the bank should “not be premature in terms of tightening.'''

''Another MPC member Haskel said 'In the immediate term, the risk of a pre-emptive monetary tightening curtailing the recovery continues to outweigh the risk of a temporary period of above-target inflation and added that, 'for the foreseeable future, in my view, tight policy isn’t the right policy.”'

The analysts explained that this stands in contrast to Deputy Governor Ramsden and MPC member Saunders, who have both hinted that they favour eliminating the final GBP50 bln of QE.

''Of note, lead hawk Haldane has departed the BOE and so the debate will be a lively one for the remaining eight members of the MPC.''

GBP/USD technical analysis

As per the prior day's analysis:

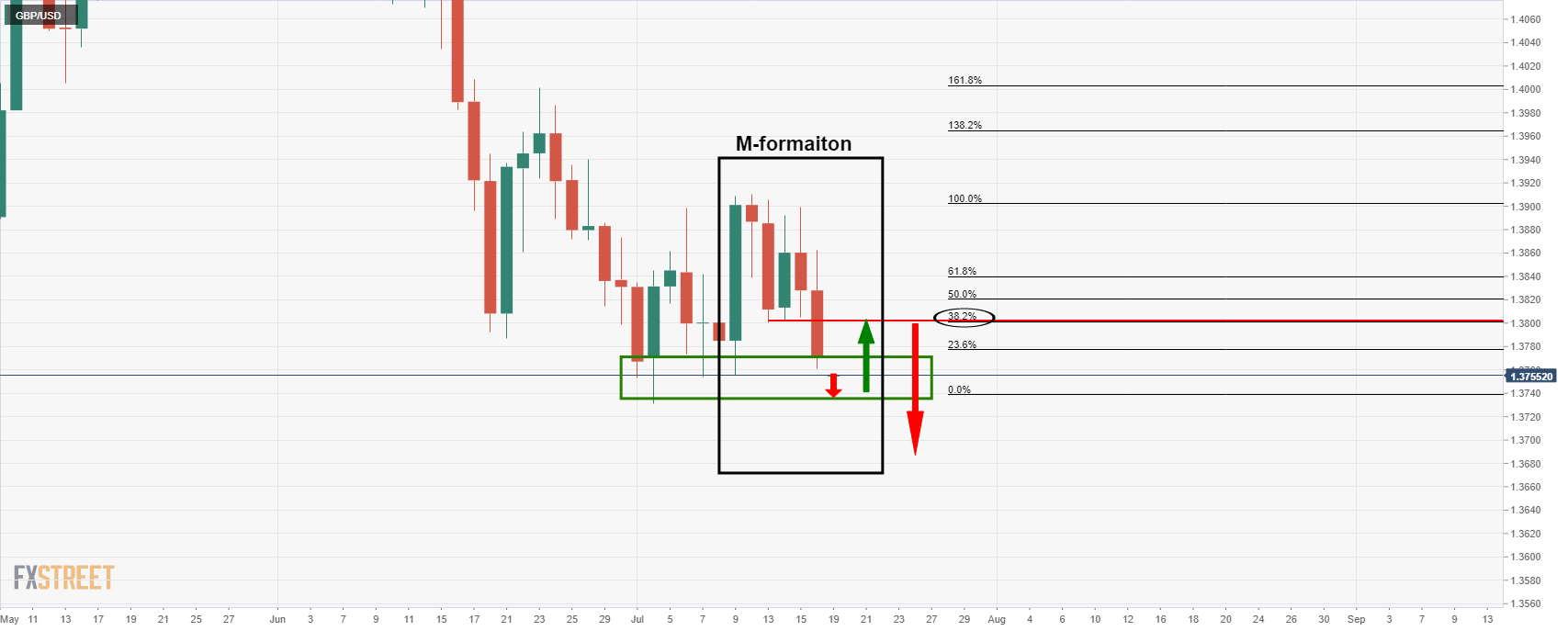

''The M-formation is compelling as the price runs into support.

On a test of a lower low, there could be a surge back to the upside to test the prior daily lows and influence of the 38.2% Fibonacci retracement level.''

... the correction was presumed too early, but the downside continued and the M-formation is still a valid pattern.

Live market update

The market is stalling on the downside and a correction to test at least the 38.2% Fibonacci retracement level at 1.37 the figure, or even the 50% mean reversion of this daily bearish impulse would be expected.

The 50% mean reversion level, nea1.3735 is especially compelling considering the confluence of the July prior lows and expected resistance structure.