Back

11 Feb 2022

Crude Oil Futures: Looks range bound near term

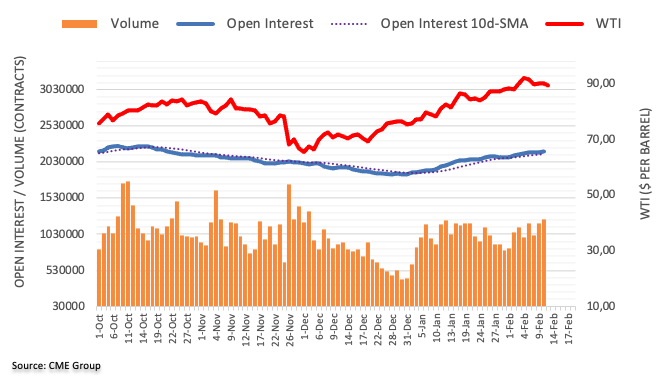

CME Group’s preliminary prints for crude oil futures markets noted traders added around 5.7K contracts to their open interest positions on Thursday, resuming the uptrend following Wednesday’s small pullback. In the same direction, volume rose for the second straight session, now by around 56.3K contracts.

WTI remains capped by $93.00 and above

Prices of the barrel of WTI charted another inconclusive session on Thursday amidst increasing volatility. The price action was in tandem with rising open interest and volume, indicative that extra range bound trading appears likely at least in the very near term.